Are you constantly chasing the next paycheck, feeling like you’re on a treadmill that never stops? Do you dream of having more control over your time and energy, but feel trapped by financial obligations? “Your Money or Your Life,” by Vicki Robin and Joe Dominguez, offers a powerful and transformative approach to personal finance, challenging conventional wisdom and providing a practical roadmap to financial independence. This blog delves into the core principles of this book, providing actionable steps to help you reclaim your life.

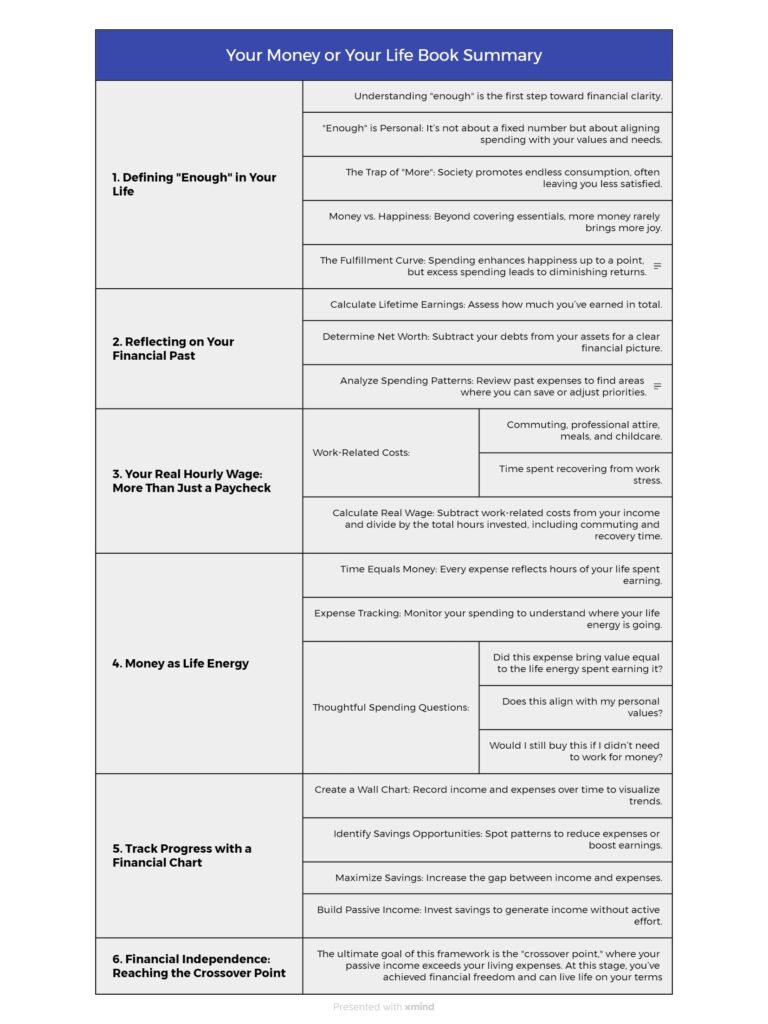

1. Defining “Enough”: A Personal Journey, Not a Destination

The first and perhaps most crucial step on the path to financial freedom is defining what “enough” truly means to you. This isn’t about accumulating vast sums of wealth or keeping up with societal expectations; it’s about identifying the level of financial security that allows you to live a fulfilling and meaningful life, aligned with your values.

- Subjectivity of “Enough”: “Enough” is not a universal number; it’s a deeply personal concept. What constitutes “enough” for one person might be vastly different for another. This is because our values, priorities, and life goals vary significantly.

- The Trap of “More”: Our consumer-driven society constantly bombards us with messages that encourage us to want “more”—more possessions, more status, more experiences. This relentless pursuit of “more” can create a cycle of dissatisfaction, where we’re never truly content with what we have.

- The Happiness-Money Paradox: Research consistently shows that beyond a certain income threshold, increased wealth doesn’t necessarily lead to increased happiness. This is because our basic needs are met, and additional income doesn’t significantly improve our overall well-being.

- The Fulfillment Curve: Imagine a graph plotting money spent against the level of fulfillment derived from that spending. Initially, spending money on necessities and essential experiences (housing, food, healthcare, basic travel) leads to a significant increase in fulfillment. However, as spending increases beyond this point, the curve starts to flatten, indicating diminishing returns. This illustrates that accumulating more material possessions or engaging in excessive consumption provides less and less additional happiness.

2. Making Peace with the Past: Understanding Your Financial History

Before you can chart a course for your financial future, it’s essential to understand your financial past. This involves taking a clear and honest look at your past earnings, spending habits, and overall financial trajectory.

- Calculating Lifetime Earnings: This exercise involves calculating the total amount of money you’ve earned throughout your working life. While it can be a confronting process, it provides valuable perspective on your earning potential and how you’ve used your resources.

- Assessing Net Worth: Calculating your net worth—the difference between your assets (what you own) and your liabilities (what you owe)—provides a snapshot of your current financial position. This gives you a baseline for measuring your progress toward financial independence.

- Analyzing Spending Patterns: Reviewing your past spending habits helps you identify areas where you might have overspent or made less-than-ideal financial choices. This isn’t about dwelling on past mistakes but rather about learning from them and developing more conscious spending habits.

3. Calculating Your Real Hourly Wage: Beyond the Paycheck

Most people focus solely on their gross hourly wage, but this figure doesn’t accurately reflect the true cost of their labor. “Your Money or Your Life” introduces the concept of calculating your “real hourly wage,” which takes into account all the expenses associated with working.

- Hidden Costs of Work: The true cost of work extends beyond the hours spent on the job. It includes:

- Commuting Costs: Time and money spent traveling to and from work.

- Work-Related Expenses: Costs associated with professional attire, meals, childcare, and other work-related necessities.

- Stress and Decompression Time: The time and energy spent recovering from the stresses of work, which often impacts personal time and well-being.

- Opportunity Costs: The value of the time and energy spent working that could be dedicated to other pursuits, such as hobbies, personal development, spending time with loved ones, or volunteering.

- Calculating Real Hourly Wage: By subtracting all these work-related expenses from your gross income and then dividing by the total hours worked (including commuting and decompression time), you arrive at your real hourly wage. This figure is often significantly lower than your perceived hourly wage, revealing the true cost of your work.

4. Money as Life Energy: A Fundamental Shift in Perspective

“Your Money or Your Life” argues that money is not simply a neutral object; it represents your life energy—the time, effort, and skills you exchange for it. This perspective encourages a more mindful approach to spending.

- Time-Money Connection: Every purchase you make represents a certain amount of time you spent working to earn that money. This connection forces you to consider the true value of your purchases.

- Tracking Expenses with Intention: Meticulously tracking your expenses helps you understand where your life energy is flowing. This awareness allows you to make more conscious choices about how you allocate your resources.

- Asking Powerful Questions Before Spending: Before making a purchase, consider these questions:

- Did I receive fulfillment and value proportional to the life energy I spent?

- Does this expenditure align with my core values and life purpose?

- Would I make this purchase if I didn’t have to work for money?

5. Tracking Your Progress: The “Wall Chart”

The book recommends creating a visual representation of your financial progress using a “wall chart.” This visual tool helps you track your income, expenses, and investment growth over time.

- Visualizing Your Financial Landscape: Creating a chart that plots your income and expenses provides a clear visual representation of your financial situation.

- Monitoring Progress and Identifying Trends: Regularly updating the chart allows you to monitor your progress toward financial independence and identify spending patterns or income fluctuations.

- Increasing the Gap: The goal is to increase the gap between your income and expenses, allowing you to save and invest more.

- Building Passive Income: Investing your savings to generate passive income is crucial for achieving financial independence. As your investment income grows, you become less reliant on earned income.

6. The Crossover Point: Reaching Financial Independence

The ultimate goal of “Your Money or Your Life” is to reach the “crossover point,” where your investment income surpasses your living expenses. At this point, you have achieved financial independence—the freedom to choose how you spend your time and energy, without being solely driven by the need to earn a living.

Conclusion: A Path to a More Fulfilling Life

“Your Money or Your Life” offers a practical framework for achieving financial freedom and living a more fulfilling life. By understanding the true cost of money, defining “enough,” and taking conscious control of your finances, you can break free from the cycle of endless work and consumption and create a life that aligns with your values and priorities.

Read more about Finance Here