Are you struggling to make ends meet, living paycheck to paycheck, or feeling crushed under the weight of debt? Do you long for financial stability and the freedom to enjoy life without money worries? If this sounds familiar, you’re not alone. Many people face these challenges, but the good news is there’s a way out. Dave Ramsey’s book, The Total Money Makeover, lays out a step-by-step plan to break free from debt and achieve financial success.

In this blog post, we’ll walk you through the core principles of The Total Money Makeover and give you practical steps to start your journey to financial freedom.

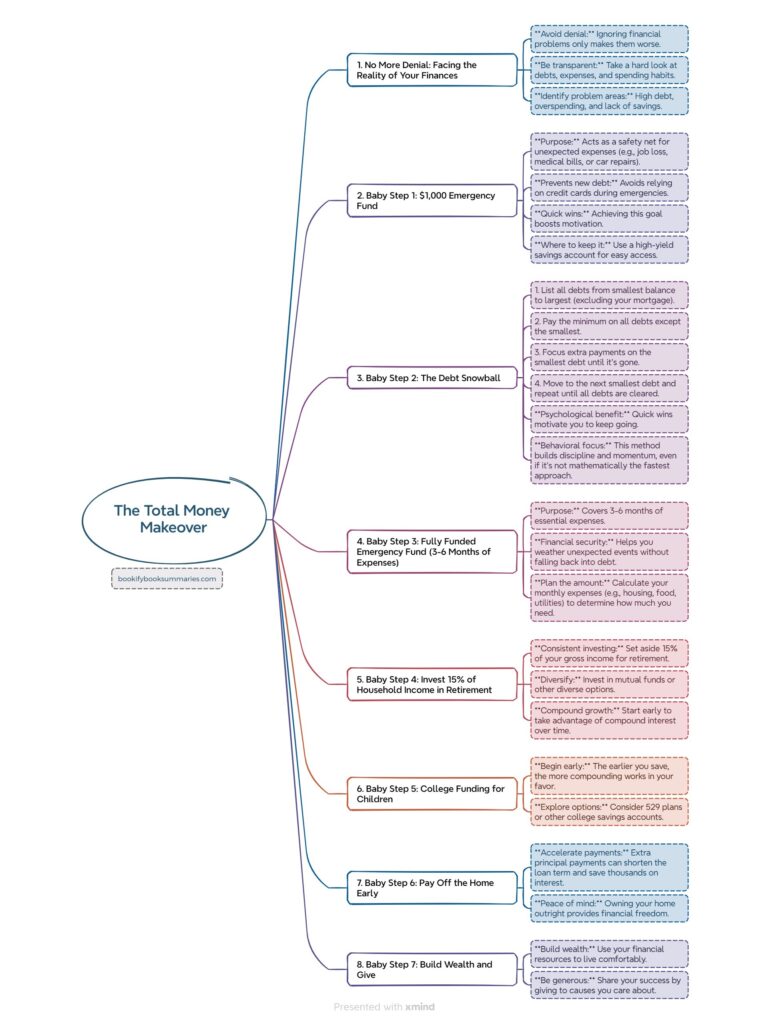

1. Face the Truth: Stop Avoiding Your Finances

The first step to turning your financial life around is accepting where you are. This means being completely honest about your debts, spending habits, and financial situation. It’s common to ignore these issues and hope they’ll go away, but avoidance only makes things worse.

Think of it like ignoring a leaking pipe—it’s only going to cause more damage over time. Instead, take a deep breath and assess your finances. Write down all your debts, list your monthly expenses, and figure out where your money is going. Facing the reality of your situation is the foundation for building a better financial future.

2. Baby Step 1: Build a $1,000 Emergency Fund

Before tackling debt, you need a safety net. Start by saving $1,000 as quickly as possible to create a small emergency fund.

- Why It Matters: This fund acts as a buffer for unexpected expenses, like car repairs or medical bills, so you don’t have to rely on credit cards.

- How to Save Quickly: Sell items you don’t need, cut non-essential spending, or take on a side hustle. The goal is to hit this milestone fast.

- Where to Keep It: Use a simple savings account for easy access. Don’t worry about earning high interest at this stage; the focus is on availability.

3. Baby Step 2: Use the Debt Snowball Method

With your starter emergency fund in place, it’s time to tackle your debts head-on using the Debt Snowball method. Here’s how it works:

- List all your debts (except your mortgage) from smallest balance to largest.

- Make minimum payments on all debts except the smallest.

- Throw every extra dollar at the smallest debt until it’s paid off.

- Once the smallest debt is gone, roll the payment you were making on it into the next smallest debt.

- Repeat this process until all debts are cleared.

- Why It Works: Paying off smaller debts first gives you quick wins and builds momentum. It’s motivating to see debts disappear one by one.

- Behavior Over Math: While this isn’t the fastest method mathematically (the Debt Avalanche method saves more on interest), the psychological boost helps most people stick to the plan.

4. Baby Step 3: Save 3-6 Months of Expenses

Once you’re debt-free (excluding your mortgage), focus on building a fully funded emergency fund. This means saving enough to cover 3-6 months of essential living expenses.

- Purpose: A larger emergency fund provides true financial security. Whether it’s a job loss or unexpected medical bills, you’ll have peace of mind knowing you’re prepared.

- How to Calculate: Add up your basic monthly expenses, like rent, utilities, groceries, and transportation. Multiply that by 3-6 to determine your target savings.

5. Baby Step 4: Invest 15% of Your Income

Now that your debt is gone and your emergency fund is secure, it’s time to think about the future. Start investing 15% of your household income into retirement accounts.

- Why 15%: It’s a balanced approach that allows you to save for the future while still enjoying life today.

- Where to Invest: Dave Ramsey suggests investing in mutual funds and spreading your investments across different asset classes for diversification.

- Start Early: The earlier you invest, the more you benefit from compound growth.

6. Baby Step 5: Save for Your Children’s Education

If you have kids, consider saving for their college education. Starting early gives your savings time to grow.

- Use the Right Tools: Look into 529 plans or Education Savings Accounts (ESAs) for tax-advantaged growth.

- Set a Realistic Goal: Decide how much support you want to provide and plan accordingly.

7. Baby Step 6: Pay Off Your Mortgage Early

With no other debts and solid investments, it’s time to tackle your mortgage. Paying off your home early can save you thousands in interest and give you complete financial freedom.

- Make Extra Payments: Even small additional payments toward your principal can significantly reduce your mortgage term.

- Celebrate Progress: Watching your mortgage balance shrink is incredibly rewarding.

8. Baby Step 7: Build Wealth and Give Generously

The final step is about enjoying your financial freedom and making a difference in the lives of others.

- Build Wealth: Continue investing, explore other income streams, and grow your net worth.

- Give Back: Use your financial resources to help others. Generosity not only makes a positive impact but also brings personal fulfillment.

Summary of Total Money Makeover

The main message of The Total Money Makeover is simple: “Live like no one else now, so later you can live like no one else.” This means making disciplined choices today—like budgeting, cutting back, and avoiding debt—to enjoy financial independence and abundance tomorrow.

By following these steps, you’ll gain control over your finances, reduce stress, and create a brighter future for yourself and your family. Start your total money makeover today and take the first step toward financial freedom!

Read more about Finance Here