Introduction Why Didn’t They Teach Me This in School ?

“Want to master the art of budgeting, investing, and navigating the financial world? Cary Siegel’s “Why Didn’t They Teach Me This in School?” provides a comprehensive guide to personal finance and essential life skills that are often missing from traditional education. This book has become a go-to resource for young adults and anyone seeking to improve their financial literacy.

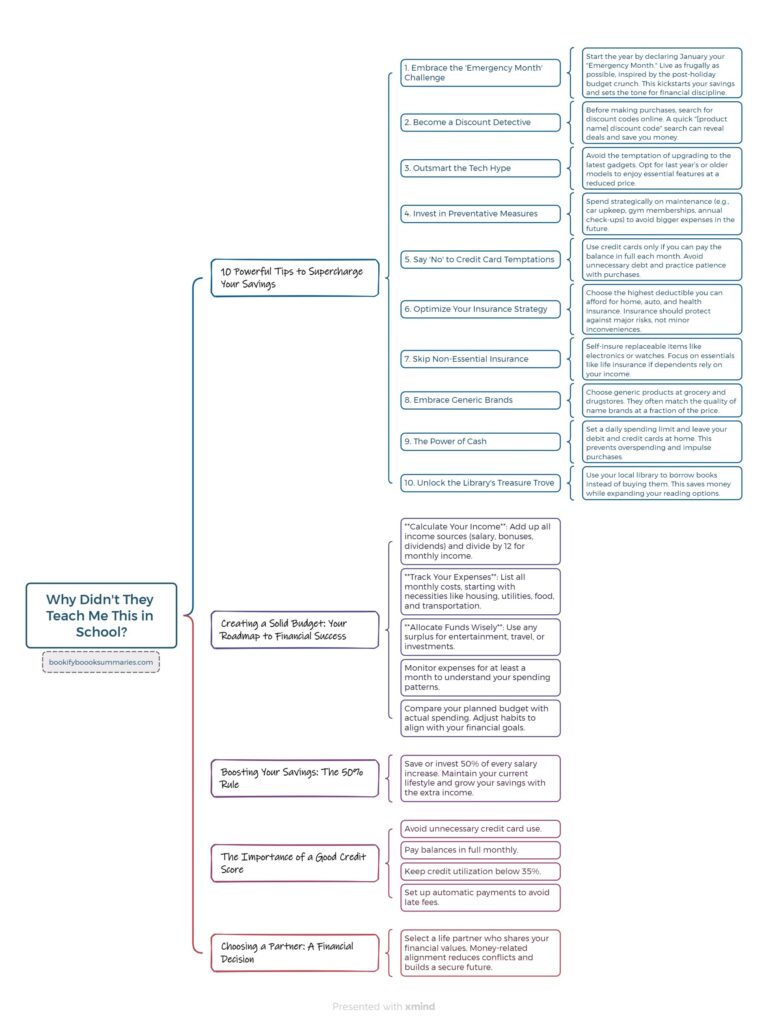

10 Tips to optimize your savings

1. Embrace the ‘Emergency Month’ Challenge: Kickstart your year with a bang by declaring January your “Emergency Month.” Challenge yourself to live as frugally as possible, taking inspiration from the post-holiday season when many people are already tightening their belts. This fun, competitive approach will jumpstart your savings and set the tone for a financially savvy year.

2. Become a Discount Detective: Before clicking that “Buy Now” button, make it a habit to scour the internet for discount codes. A quick Google search for “[product name] discount code” can unlock amazing deals and save you a surprising amount of money.

3. Outsmart the Tech Hype: Don’t fall prey to the pressure of always having the latest gadgets. Last year’s smartphone model (or even the one from two years ago) can offer excellent functionality at a fraction of the price. You’ll still enjoy all the essential features without breaking the bank.

4. Invest in Preventative Measures: Sometimes, spending strategically can lead to significant long-term savings. Prioritizing car maintenance, gym memberships, and annual health check-ups can prevent costly problems down the line.

5. Say ‘No’ to Credit Card Temptations: Resist the allure of credit cards unless you can comfortably pay off the balance in full each month. Buying on credit can lead to a dangerous cycle of debt and inflated costs. Remember, patience is a virtue. If you can’t afford something now, wait until you can.

6. Optimize Your Insurance Strategy: Choose the highest deductible you can comfortably afford for your home, auto, and health insurance. Insurance is designed to protect you from catastrophic events, not minor inconveniences.

7. Skip the Non-Essential Insurance: Think twice before insuring items like TVs or expensive watches. In most cases, you can self-insure for these replaceable possessions. However, prioritize life insurance if you have dependents relying on your income.

8. Embrace Generic Brands: Don’t overpay for fancy packaging. Generic grocery and drugstore products often come from the same manufacturers as name brands, offering the same quality at a lower price. Remember, you’re consuming the product, not the packaging.

9. The Power of Cash: Set a daily spending limit when shopping and leave your debit and credit cards at home. This simple trick helps you stay within your budget and avoid impulse purchases, especially in tempting environments like IKEA.

10. Unlock the Library’s Treasure Trove: Take advantage of your local library’s vast collection of books. Borrowing instead of buying will save you money and allow you to explore a wider range of titles.

Creating a Solid Budget: Your Roadmap to Financial Success

Effective budgeting is the cornerstone of financial stability. It’s not about restricting yourself; it’s about empowering yourself to make informed decisions about your money.

Step 1: Develop Your Budget:

- Calculate Your Income: Begin by estimating your annual income from all sources (salary, bonuses, dividends, etc.) and divide by 12 to get your monthly income.

- Track Your Expenses: List all your monthly expenses, starting with necessities like housing, utilities, food, transportation, and loan payments. Remember to prioritize saving by “paying yourself first.” This means setting aside a portion of your income for savings before allocating funds to other expenses.

- Allocate Funds Wisely: If you’ve budgeted correctly, you should have money left over after covering your necessary expenses. This surplus can be used for entertainment, travel, or, even better, investments that will grow your wealth.

Step 2: Track Your Spending:

- Monitor your expenses diligently for at least a month (ideally, a year) to get a clear picture of where your money is going.

Step 3: Analyze and Adjust:

- Compare your planned budget to your actual spending. Are you sticking to your priorities? If not, it’s time to reassess your spending habits and make adjustments to align with your financial goals.

Boosting Your Savings: The 50% Rule

One of the most effective strategies for accelerating your wealth-building journey is to invest 50% of every salary increase you receive. This approach allows you to enjoy the benefits of a raise while simultaneously boosting your savings. Remember, you were living comfortably on your previous salary, so you can maintain your current lifestyle and invest the extra income for a brighter future.

The Importance of a Good Credit Score

Building and maintaining a good credit score is crucial for a healthy financial life. It impacts your ability to secure favorable interest rates on loans, rent apartments, and even land certain jobs. To keep your credit score in top shape:

- Avoid unnecessary credit card use.

- Pay your credit card balances in full each month.

- Keep your credit utilization below 35% of your available credit limit.

- Set up automatic payments for recurring expenses to avoid late fees.

Choosing a Partner: A Financial Decision

While love is undoubtedly a powerful force, it’s essential to consider the financial implications of choosing a life partner. Money is a common source of conflict in relationships, so selecting a partner who shares your financial values and practices responsible money management can contribute to a happier and more secure future.

Conclusion

Building a strong financial defense is within everyone’s reach. By implementing these practical tips from Why Didn’t They Teach Me This in School?, you can take control of your money, save more effectively, and accelerate your journey toward financial freedom. Remember, small changes can make a big difference over time. Start today and watch your financial well-being flourish.

Read more about Finance Here