Asian Paints

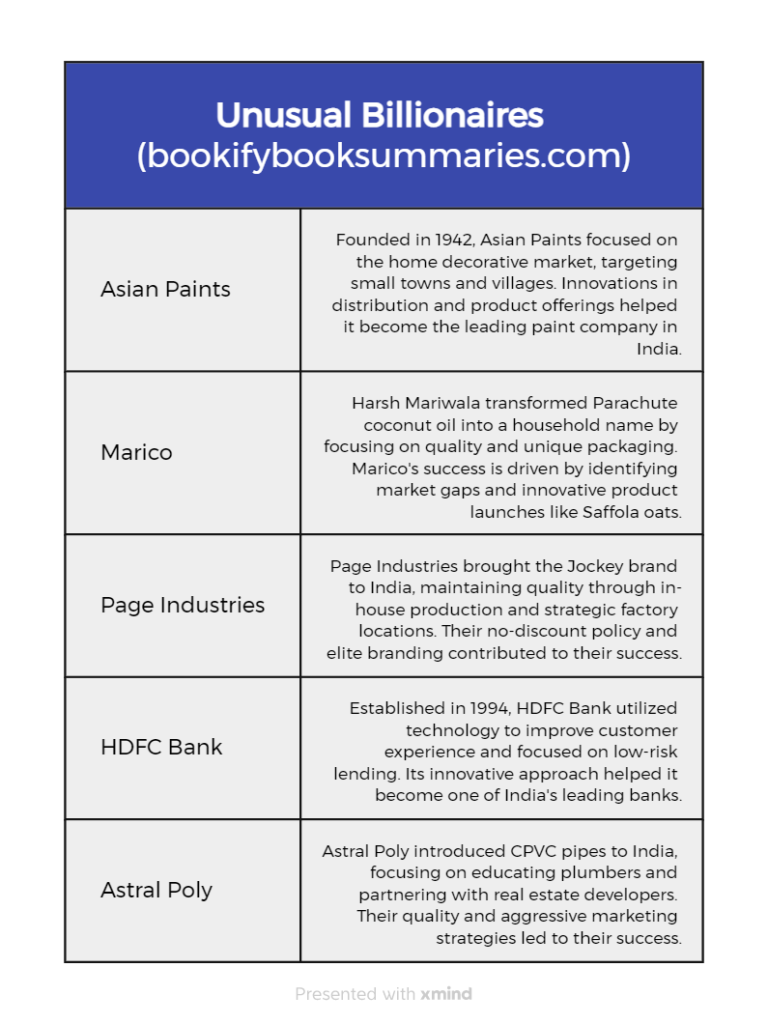

In 1942 during world war there was a temporary ban in Import of paints in India. Looking at the domestic demand, Chimanlal Choksi and his three friends opened a small company called Asian Paints. At that time there were two markets of paints, industrial prints and home decorative prints. Industrial Paints was a low margin business there was very less profit in it and domestic paint was majorly dominated by putty because people were not used to decorating their homes so much as they are now.

Chimanlal Choksi targeted the home decorative segment, his vision was that every home should look fantastic, should look colorful and the paint should last for a long time, but unfortunately there was no support from distributors in big cities because of already established players, so he started targeting small cities and villages. To sell his paint in small cities and villages he doesn’t need a big distribution network, he set up small stores, identified their needs. He studied the kind of paints and the color scheme which are being used in the local festivals in villages and small cities.

What he found after a survey was the number of color varieties in small in small villages is more and the roads are not perfect for transport of paints in large quantities or big barrels, so he came up with the idea that he will transport exact requirement or we can say approximate requirement of the paint which is required for the particular festival in a particular household and those small containers were easy to transport looking at the road conditions of the villages and since he was selling the paint directly to the customer, there was no middle man, there was no distributor involved, people were more than happy to purchase the paint directly with the manufacturer.

Slowly people became familiar with the paint and it became their no-brainier choice, so looking at the popularity of Asian Paints, various distributors started stocking Asian Paints. In the home decorative segment emulsion paint was an emerging category, it was being used by high class people because of its high quality and a shiny finish and other people were mostly using putty which was a very low cost item and it is used to give a very rough finish. Asian Paints game developed a washable emulsion paint whose cost was less than emulsion paint but more than the putty. people were happy to pay for the low cost washable emulsion paints, it which was durable and affordable

Because of all these innovations and popularity in customers in 1967 Asian Paints became the number one paint company in India. Asian Paint was also one of the few companies in 1970\’s which adopted rapid computerization and electronic handling of huge amounts of customer data that gave them a edge over computers in their operations and reduced cost of operations.

Asian Paints also brought out this scheme where they used to give discount to distributors when they are paying in advance and they used to compensate distributors in case of any loss.In terms of marketing they did emotional marketing to show that home is a place which is very close to the people and home should be decorated

All these things made Asian Paint number one paint company and their position is maintained today as well and the same was reflected in their stock market performance. For reference if you had invested 1 rupees in Asian paints in 1991 today it would have been 299 rupees but if you would have invested Rs 1 in Sensex in 2016 it would have been 26 rupees only.

Marico

Harsh Mariwala who used to work in his father\’s company BOIL during 1971, This company was related to oil and spices. In 1990 he started his own company MARICO and its brands were Parachute and Saffola. Parachute coconut oil as you know is a famous coconut oil which is sold today also in the Indian market, but how did it become a household name, how did it become so famous.

Mariwala started selling coconut oil in very small bottles which was very affordable to normal Indian customers and the shape of the bottle was unique, the mould for which was imported from foreign, which could not be easily made in India. In order to maintain the quality he purchased coconut directly from farmers and did a joint partnership with the farmers society. In 1990 parachute coconut oil was very famous and Hindustan Unilever gave an open offer to Mariwala to sell his brand parachute coconut oil. That time Hindustan Unilever was a big multinational company and Marico was a relatively small company selling only a few brands. Harsh Mariwala refused to sell his brand. HUL was not ready to give up so it started a marketing war with Marico\’s Parachute oil which led to a lot of spending in advertisement from both the companies. Although the amount of money was more with HUL but in the end Parachute oil was undefeated and it kept on gaining the market share and HUL’s Nihar oil kept lagging in the coconut oil market in India. After a few years down the line Marico itself purchased the Nihar brand of HUL.

Three strategies of MARICO success 👍

- Identify market gaps in segment.

- Launch products in that segment in a small market.

- Expand aggressively after initial results are good.

Saffola oats was introduced by marico which became instant. It was different from Quaker oats in the terms that it had this unique Indian masala flavour in it and not tasteless like a Quaker oats.

The success of MARICO was reflected in its share price. 1996 to 2016 if you would have invested 1 rupees in MARICO it would have become 117 rupees and if you would have invested 1 rupees in Sensex it would have been only RS 7 rupees.

Page Industries

Page Industries is a company for the brand of undergarments called Jockey. Samuel Copper founded Jockey shorts in the USA and it became a famous brand in the USA. During the world war when US soldiers were in South Asia, the demand for Jockey shorts in south east asia was increasing. A Sindhi businessman Sunder Genomal imported Jockey shorts from USA and started selling it in Philippines. Jockey brand came to India after 1991 Indian markets opened up for the Global products. Mr Genomal tied up with the US company and opened Jockey stores in India. The company was named in India as Page Industries. At that time economic undergarment brands were Rupa, Lux, dollar and some of the luxury brands were TTK and associated apparels. These luxury brands were not very much popular and due to labour strikes and other disturbance they closed down their brand. This market gap was filled by Jockey,

but how did Jockey become so famous as it is today?

In order to maintain the quality they started self production of the elastic and fabric. At that time other economic brands used to outsource manufacturing and just rebrand it. Genomal was a smart person, he selected Karnataka where there were less Union problems. He set up a factory in Karnataka and strategically gave jobs to 80% of women employees. He gave free lunch to all laborers and free medical facilities for all. And to maintain standard Jockey undergarments were never offered in discounts, till today you will not find any big discounts in Jockey undergarments also their advertisement mainly involves foreign models because it is projecting itself as the brand of the elite and young.

HDFC Bank

Deepak Parikh, who was earlier the boss of HDFC setup HDFC Bank in 1994. He called Aditya Puri from Citibank and made him in charge of HDFC Bank. No in order to understand the success of HDFC Bank we have to look into how a bank makes money bank deals in mainly three components : current and saving accounts (CASA) second is term deposits like FD/RD etc and the third is lending. CASA is very low cost for the banks and they have to pay interest to the persons who are keeping the money in the bank which is less than inflation, they have to give a little bit higher rate of interest for the people who are keeping money in FD/RD. Banks make money by lending it to corporates and other retail customers at higher interest rates.

so we can see that a bank which has high proportion of CASA will have very low cost funds for lending to corporate and retail customers, So HDFC Bank took the help of technology and some strategic partnerships to increase dear CASA. When the bank was set up that time the salaries were credited manually so it use to take 2 to 3 days to be reflected in account, so they introduce computerization at that time which lead to salary being created in the customers account on the same day. HDFC Bank also tied up with traders and investors for stock market settlements. That time after purchase or sale of shares the settlement used to take 3 to 4 days and with the use of Technology HDFC Bank reduced it to one day. Many retail customers and companies started preferring HDFC bank because of the ease of transaction and the use of Technology. When it comes to corporate landing instead of lending to high risk customers, the bank focused only on lending to blue chip companies. In 2000 HDFC Bank was the first bank to introduce mobile banking in India. In 2009 financial crisis Indian village market was not much affected because of their savings, so during the time HDFC Bank targeted small cities in villages with the small kinds of loan like gold loan, two wheeler loan, personal loans etc which help them sail through recession.

The same thing was reflected in the HDFC Bank stock prices also, between 1995 to 2016 Rs 1 in HDFC Bank became 134 Rupees, in the same time 1 rupees invested in Sensex became only 8 rupees

Astral Poly

Mr Sandeep Engineer left his job in the pharma company and started Astral Poly. He tied up with the US firm in 1996 and took the technology from them and started making CPVC pipes in India. At that time in India GI pipes mostly Gi pipes were mostly used. GI pipes were cheap but due to corrosion their life was less. But initially nobody was interested in CPVC pipes and by 2003 the company was almost at the edge of bankruptcy but Sandeep Engineer did not stop. He took some more funds from US company and started focusing on plumbing business specifically and plumbers specifically, because plumbers are the ones who get to select which pipe to use. So he started giving training to plumbers and he tied up with plumbing association and convinced them to use CPVC pipes educating about quality of CPVC Pipe and plumbers also thought this pipe will last long and easy to handle so why not try this. Not this move was a very smart one and it made CPVC pipe famous in India and Astral poly was a term used to denote CPVC pipes in India. If someone wanted to buy a PVC pipe he would just go and say I need a Astral Poly pipe as the name became synonymous for the PVC pipes. He also tied up with various real estate developers and investors to use CPVC Pipes in construction. Finally after 5 years the company became profitable. After that they focused on aggressive advertising, improvement in quality and latest technology of pipes to grow.

Success of the company was reflected in its stock market performance also from 2007 to 2016 1 rupees invested in Astral poly became 36 rupees and 1 rupees invested in Sensex will only became 2 Rupees.

Apart from these companies the author has discussed the story of Axis bank and Berger Paints but that\’s it for this blog. I will suggest if you are interested you can go read the book. The author has also given tips on how to identify such interesting businesses and invest in them.