Tony Robbins‘ “Money: Master the Game” isn’t just another personal finance book; it’s a comprehensive guide to achieving financial freedom, drawing on insights from interviews with over 50 of the world’s top financial minds, including Carl Icahn, Ray Dalio, and Warren Buffett. This blog post details the core principles of the book, providing strategies to help you navigate the complex world of finance and ultimately “master the game.”

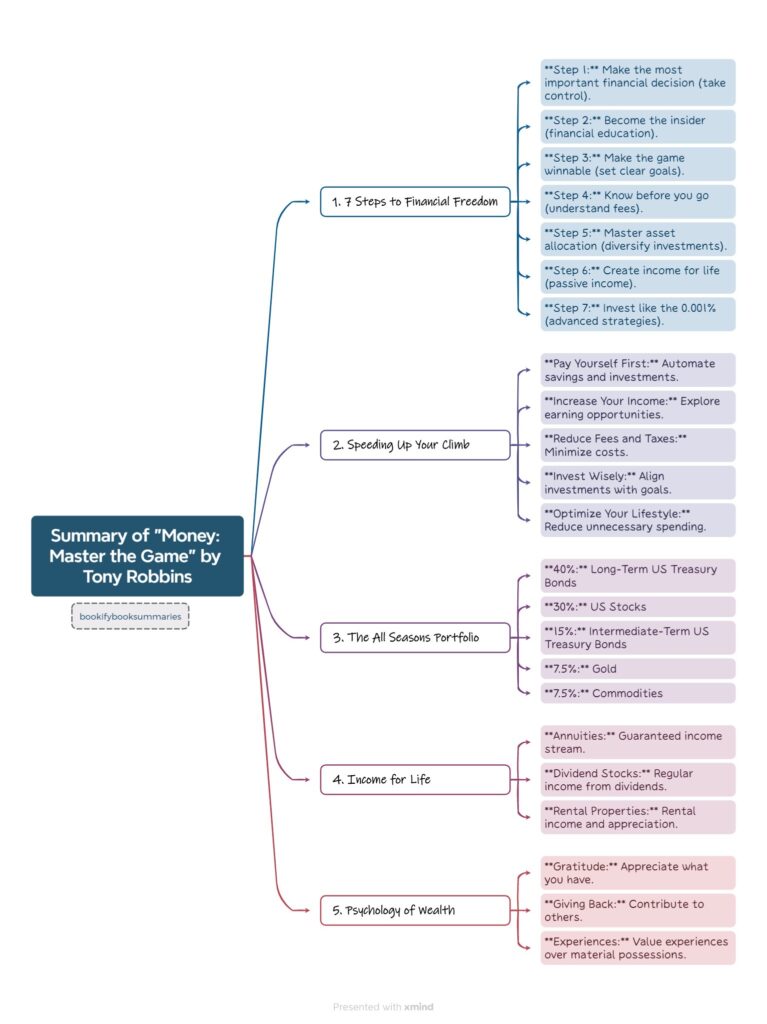

1. The 7 Steps to Financial Freedom: Climbing Your Personal Mountain

Robbins outlines seven steps to financial freedom, framing the journey as climbing a mountain. Each level represents a different stage of financial security:

- Step 1: Make the Most Important Financial Decision: This involves recognizing that you are the driver of your financial destiny. You must take responsibility and commit to achieving financial freedom.

- Step 2: Become the Insider: This step emphasizes the importance of financial education. Understanding basic financial concepts, investment strategies, and market dynamics is crucial for making informed decisions.

- Step 3: Make the Game Winnable: This involves setting clear financial goals and creating a concrete plan to achieve them. This includes calculating your “freedom number” – the amount of money you need to generate in passive income to cover your desired lifestyle. A common method is multiplying your annual expenses by 25.

- Step 4: Know Before You Go: This step focuses on understanding the fees and costs associated with investing. Even small fees can significantly erode your returns over time. Minimizing these costs is essential for maximizing your wealth.

- Step 5: Master the Game of Asset Allocation: This involves diversifying your investments across different asset classes, such as stocks, bonds, real estate, and commodities. Proper asset allocation can help mitigate risk and enhance returns.

- Step 6: Create an Income for Life: This step focuses on generating passive income streams that can sustain your lifestyle in retirement. This can be achieved through various methods, such as dividend-paying stocks, rental properties, or annuities.

- Step 7: Invest Like the 0.001%: This step explores advanced investment strategies employed by sophisticated investors. It emphasizes the importance of continuous learning and adapting to changing market conditions.

2. Speeding Up Your Climb: Strategies for Accelerated Progress

While the seven steps provide a roadmap, certain strategies can significantly accelerate your journey to financial freedom:

- Pay Yourself First: Automate savings and investments by setting up automatic transfers from your paycheck. This ensures consistent contributions to your financial goals.

- Increase Your Income: Explore opportunities to increase your earning potential, such as acquiring new skills, pursuing a side hustle, or negotiating a raise.

- Reduce Fees and Taxes: Be mindful of investment fees, expense ratios, and tax implications. Minimizing these costs can significantly boost your net returns.

- Invest Wisely: Choose investment strategies that align with your risk tolerance, time horizon, and financial goals.

- Optimize Your Lifestyle: Identify areas where you can reduce unnecessary spending without sacrificing your quality of life.

3. The All Seasons Portfolio: A Robust Investment Strategy

Inspired by Ray Dalio’s research, Robbins introduces the “All Seasons Portfolio,” a diversified investment strategy designed to perform well in various economic conditions. It’s built on the principle that economic cycles are driven by changes in inflation and economic growth. The portfolio consists of:

- 40% Long-Term US Treasury Bonds: These provide stability during periods of deflation and economic slowdown.

- 30% US Stocks: These offer growth potential during periods of economic expansion.

- 15% Intermediate-Term US Treasury Bonds: These provide a balance between stability and growth.

- 7.5% Gold: This acts as a hedge against inflation and currency devaluation.

- 7.5% Commodities: These provide diversification and protection against rising prices.

This portfolio is designed to weather any economic storm, offering a balanced approach to investing with relatively stable returns over the long term.

4. Income for Life: Securing Your Future

Generating a reliable income stream in retirement is crucial for financial security. Robbins explores various strategies for achieving this, including:

- Annuities: These insurance products provide a guaranteed income stream for a specified period or for life. They can offer peace of mind by ensuring a steady flow of income, regardless of market fluctuations.

- Dividend-Paying Stocks: Investing in companies that pay regular dividends can generate a consistent stream of income.

- Rental Properties: Owning rental properties can provide rental income and potential appreciation in value.

5. The Psychology of Wealth: Beyond the Numbers

Robbins emphasizes that achieving financial freedom is not just about numbers; it’s also about mindset and psychology. He highlights the importance of:

- Gratitude: Appreciating what you have can create a sense of abundance and contentment.

- Giving Back: Contributing to causes you care about can provide a sense of purpose and fulfillment.

- Experiences: Investing in experiences rather than just material possessions can lead to greater happiness and satisfaction.

Conclusion: Mastering the Game and Living a Rich Life

“Money: Master the Game” offers a comprehensive and actionable guide to achieving financial freedom. By understanding the core principles, implementing effective strategies, and adopting a positive mindset, you can take control of your financial destiny and create a richer, more fulfilling life. It’s not just about accumulating wealth; it’s about using your financial resources to create a life you love.

Read more about Finance Here