Introduction

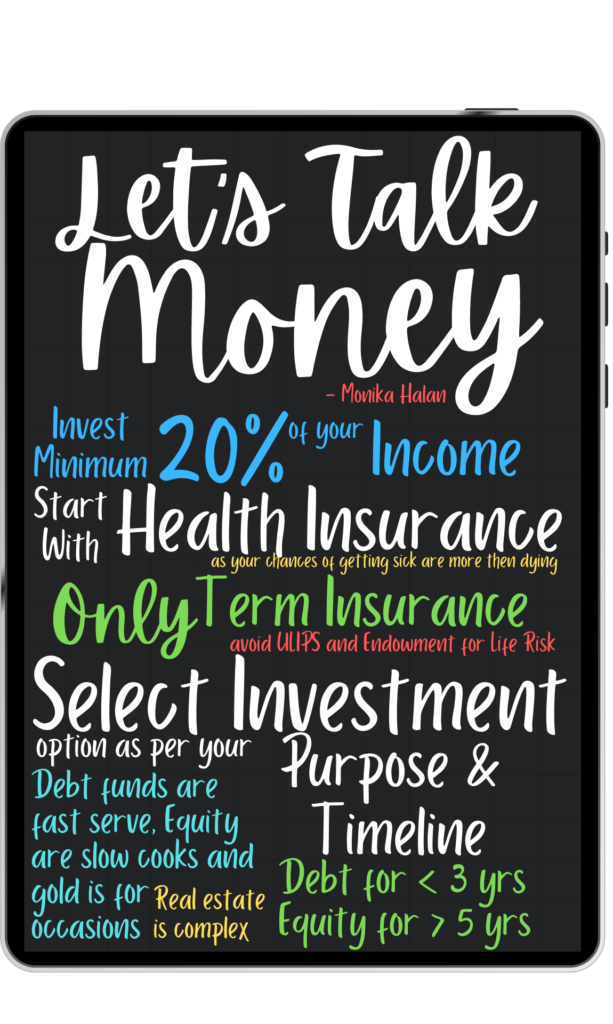

Hello friends! If you’re watching investment videos on YouTube and feeling confused about where to invest, I’m here to clear up your confusion. While it’s true that the right investments can grow your wealth, investing isn’t just about increasing your money. You invest because you’ll need funds for specific purposes in the future, such as marriage, holidays, children’s education, or retirement. Every investment should have a purpose and a timeline. Today from the book Let’s Talk Money written by Monika Halan ill make it easy for you to plan your investment journey.

Step 1: Control Your Expenses

If you often wonder where your money goes, you need to manage your cash flow properly. To do this, you’ll need three bank accounts:

- Income Account: Where your income is deposited.

- Spending Account: Where you keep money for your spending and EMIs.

- Investment Account: Where you save money to invest for specific purposes.

A simple rule of thumb is to allocate 50% of your income to spending, 30% to EMIs, and at least 20% to investments. By maintaining these three accounts, you can easily manage your finances.

Step 2: Make Investment Decisions

Let’s meet Raju, who started his job at 25 and began investing. By 30, he got married, and by 35, he had two children. His children will start their education at 14, and Raju plans to retire at 60. While your life events may not match Raju’s exactly, the key events will be similar: marriage, children’s education, and retirement.

Raju starts investing for all these planned events. But life doesn’t always go as planned. There are unplanned events like job loss, health complications, or untimely death. These can disrupt your financial plans. Therefore, it’s crucial to cover unplanned events first:

- Health Insurance: Since health costs can wipe out your savings, you need health insurance based on your city and facilities.

- Life Insurance: To protect your family’s future in case of your untimely death, term insurance is recommended as it offers pure life coverage.

- Emergency Fund: Save at least 3-6 months of expenses in a liquid form like FD or liquid funds for job loss or other emergencies.

Step 3: Plan Your Investments

There are various investment options available:

- Public Provident Fund (PPF)

- Mutual Funds (Debt, Hybrid, Equity)

- Gold (Mutual Funds and Sovereign Gold Bonds)

- Real Estate

Mutual funds are managed by experts who invest your money in different assets. Debt mutual funds invest in government bonds and commercial papers. Equity mutual funds invest in company shares. Hybrid funds split your investment between debt and equity.

Historical Performance of Investments

For example, if you invested ₹1 lakh in different instruments in 1980, their values in 2020 would be:

- Fixed Deposit: ₹19.35 lakhs

- Gold: ₹16.10 lakhs

- Public Provident Fund: ₹2.25 crores

- Sensex: ₹2.3 crores

Real estate returns depend on location and economic conditions but can be illiquid and involve dealing with black money. For example if you would have invested in small piece of land in Gurgaon, your investment would have become 4 times by the time city was renamed as Gurugram which is about time period of 10 years.

How to Choose Where to Invest

- Less than 3 years: Debt mutual funds or fixed deposits.

- 3-5 years: Balanced or hybrid mutual funds.

- More than 5 years: Equity mutual funds.

- Retirement (15+ years): Public Provident Fund (PPF).

Calculate Your Financial Needs

To calculate how much money you’ll need in the future, use the rule of 72. Divide 72 by the inflation rate to find how many years it will take for expenses to double. For example, with a 6% inflation rate, expenses will double in 12 years.

Full proofing your money

As you age, increase the percentage of your income going into your investment account. At 30, it should be 30%; at 40, 40%; and at 50, 50%. Also, ensure you have a will to avoid disputes and legal hassles for your heirs.

By following these steps, you can manage your investments wisely and secure your financial future. Take care and goodbye for now!

Make a Will

Most of the people make money and purchase property in their lifetime but do not put it in any will. if you have more than one children to avoid unnecessary fights and lawyer’s taking advantage of situation. You should make a will which can be used to distribute property in case of your death.

Conclusion

Investing is not just about growing your money; it’s about securing your future. By controlling your expenses, making informed investment decisions, and planning for both planned and unplanned events, you can ensure financial stability. Follow these steps from Monika Halan’s ‘Let’s Talk Money’ to become a savvy investor.

Want to learn more about Investment do read Coffee Can Investing by Saurabh Mukherjea