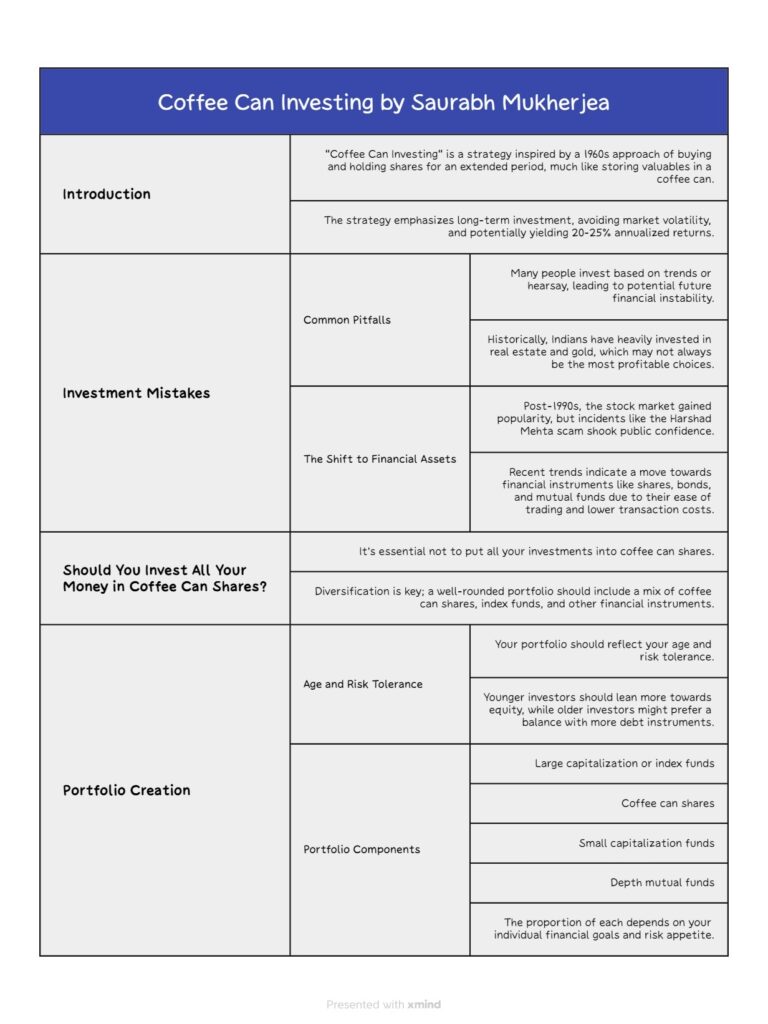

In 1960, a fund manager named Robert Kirby had a customer whose husband purchased $5,000 shares on his recommendation but never sold them. They realized after he died that he had amassed a large fortune. His investments in Xerox totaled more than $8 million. Kirby was so impressed with his buy-and-forget strategy that he called it Coffee Can Investing. Coffee Can received its name from aboriginal Americans storing their riches in coffee cans back in the day.

While the strategy appears simple on the surface, it is extremely difficult to implement because avoiding market volatility and holding stocks for more than ten years is extremely difficult. However, it is time for you to be lazy with your investment approach as well, my friend, because this strategy has not only outperformed the benchmark since 1990, but has also provided 20 – 25% annualized returns.

Saurabh Mukherjea’s book “Coffee Can Investing” discusses the shift away from traditional investment vehicles such as gold and real estate and toward financial markets. He also gives factors for selecting stocks for investment.

Investment Mistakes

Many people have no expertise of investing and base their investments on hearsay or current trends. Any investment made without a specific aim may jeopardize your financial situation in the future. According to the RBI report of 2017, Indians invested 77% of their savings in real estate and only 5% in financial assets. India’s real estate investment boom began in 1995. Following deregulation in 1990, the stock market boomed and many people began to profit, but the Harshad Mehta hoax in 1992 damaged the public’s trust in the stock market. SEBI also began regulating the stock market. The digitization of shares was established. Shares were dematerialized, and a Demat account was required for share sales and purchases. SEBI made stock market investments fully transparent. As a result, in 1995, all of India’s black money began to pour into real estate and gold. This friendship lasted till 2013. After 2013, a declining trend in real estate prices emerged.

There were several causes behind this.

1) Demonetisation

2) Real Estate Act.

3) Direct benefit transfer.

4) GST bill.

To invest in real estate, you must pay many expenses such as stamp duty and registration fees. Additionally, you must work hard to sell the property. In most cases, dealing with black money occurs during the sale or acquisition of property. When compared to other financial products, the charges for selling and purchasing shares are quite low, and it is very simple to sell or buy a share. So, based on current trends, the next decade will see money earned in stock market instruments such as shares, bonds, mutual funds, and so on.

Decide the objective.

Any investment has three goals: security, stability, and ambition. Your future should be safe; you should be able to cover any future emergencies and have all of your future expenses covered. Your standard of living should improve over time. Your dream, your bucket list, your desire to be affluent in the future. You must calculate the money required for all of these reasons in the future, taking into account inflation.

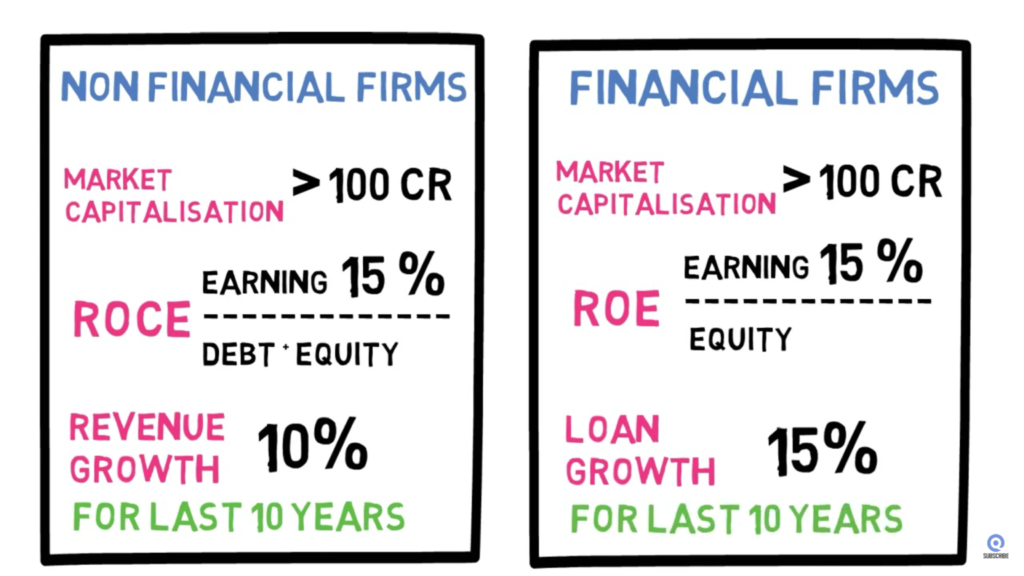

In the good old days, Americans used to save their money in coffee cans. On similar lines, the author advocates buying shares in good firms and letting them alone for the next ten years, much like money is left in coffee cans for many years. The author proposed several technical criteria for selecting enterprises to hold for ten years.

Criteria for selection of Coffee Can Shares

Should you invest all of your money in coffee can shares?

The answer is no; you must build a portfolio that includes coffee can shares.

Portfolio Creation

Following the selection of your investing objective and coffee can shares, the following stage is to decide on your portfolio. Your portfolio is based on your age and risk tolerance. At a young age, you should be more exposed to equity than debt. As you become older, your contribution to equity should decrease while your debt should climb.

What should you include in your Portfolio ?

large capitalization or index fund

Coffee can shares

Small capitalization fund

Mutual Funds invest in depth funds.

The amount of money you devote to each depends on your age and risk tolerance.

Happy Investing

Pingback: How to Make Smart Investments: Key Insights from 'Let's Talk Money' - Bookify Book Summaries