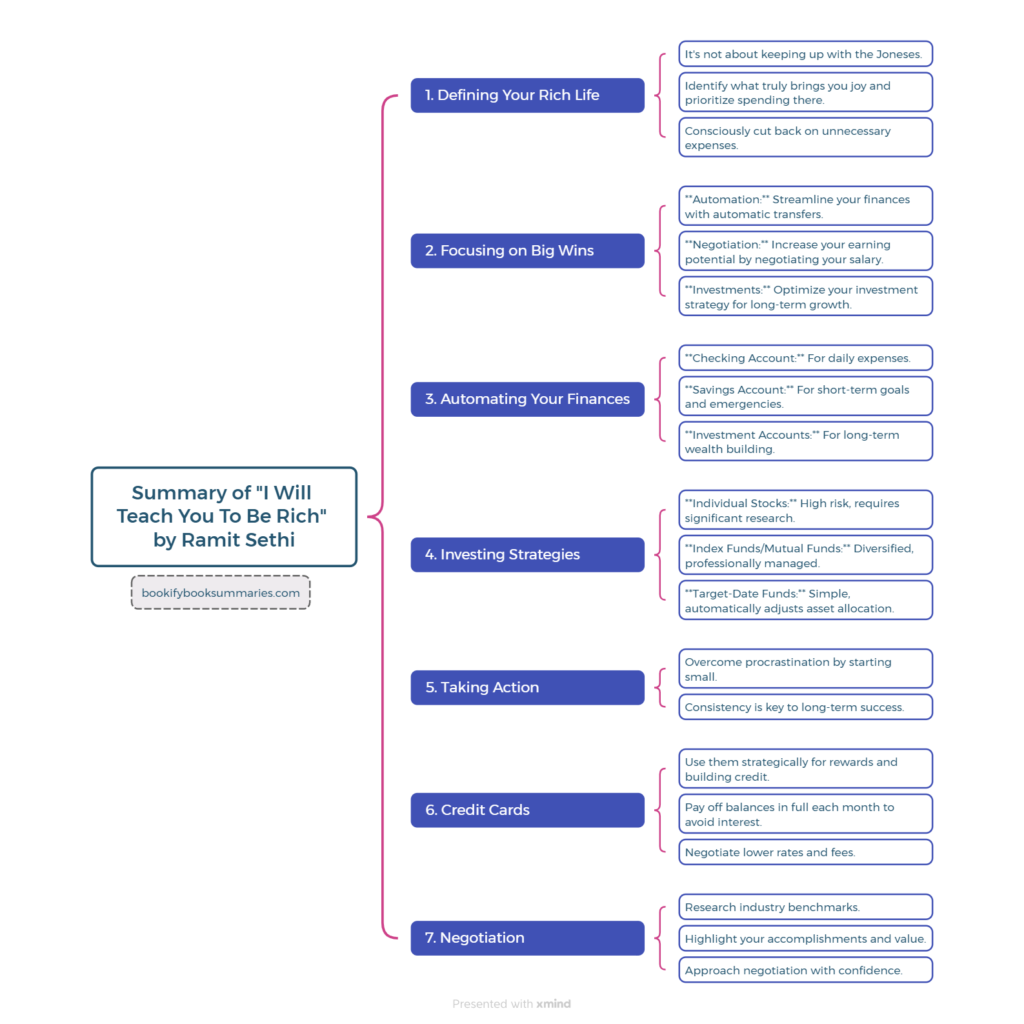

Are you tired of living paycheck to paycheck? Do you dream of achieving true financial freedom, a life where money is a tool to achieve your goals, not a constant source of stress? Ramit Sethi’s “I Will Teach You To Be Rich” offers a practical, no-nonsense approach to personal finance, cutting through the jargon and providing actionable steps to build wealth. This blog highlights the core principles of Sethi’s book, providing valuable insights for anyone seeking to take control of their financial future.

1. Define Your Rich Life: Beyond the Dollar Sign

The traditional definition of “rich” often conjures images of extravagant wealth – mansions, luxury cars, and private jets. However, Sethi challenges this notion, emphasizing that wealth is subjective and deeply personal. It’s not about keeping up with the Joneses or accumulating material possessions for the sake of it; it’s about defining what truly brings you joy and aligning your spending with those core values.

This involves conscious spending, a deliberate and mindful approach to how you allocate your resources. It means prioritizing what you love – whether it’s travel, dining out, pursuing a hobby, or spending quality time with loved ones – and ruthlessly cutting back on what you don’t. This personalized approach to wealth allows you to focus your financial efforts on what truly matters, creating a fulfilling and meaningful financial life that aligns with your individual aspirations. It’s about designing a “rich life” that is unique to you.

2. Stop Sweating the Small Stuff: Focus on the Big Wins

Many people get bogged down in the minutiae of saving pennies on coffee or clipping coupons. While frugality has its place, especially when starting out, Sethi argues that focusing on the “big wins” yields far greater results in the long run. These big wins include:

- Automating your finances: Setting up automatic transfers to savings and investment accounts ensures consistent progress toward your financial goals, removing the temptation for impulsive spending and making saving a seamless part of your routine.

- Negotiating your salary: Even a small percentage increase in your salary can have a significant long-term impact on your earning potential, compounding over time to create substantial wealth.

- Optimizing your investments: Choosing the right investment strategy, understanding asset allocation, and minimizing fees can dramatically accelerate your wealth-building journey.

By shifting your attention from micro-management to macro-optimization, you can achieve substantial financial progress without sacrificing your quality of life or becoming overly fixated on minor expenses.

3. The Power of Automation: Building Your Money Machine

One of the most powerful concepts in “I Will Teach You To Be Rich” is the idea of automating your finances. By setting up automatic transfers and payments, you create a system that works for you, even when you’re not actively thinking about money. This system typically involves:

- Checking account: For everyday expenses, bills, and regular transactions.

- Savings account: For short-term goals, emergencies, and building a financial safety net.

- Investment accounts: For long-term wealth building, retirement planning, and achieving your financial dreams.

Automating these processes removes the temptation for impulsive spending, ensures consistent progress toward your financial goals, and frees up your mental energy to focus on other important aspects of your life.

4. The Investing Pyramid: Choosing the Right Strategy for You

Sethi presents a simplified approach to investing, outlining three main levels:

- Individual Stocks: This is the most complex and risky option, requiring significant research, analysis, and ongoing monitoring. It’s generally not recommended for beginners.

- Index Funds and Mutual Funds: These offer diversification across a broad range of stocks or bonds, providing a more stable and less volatile investment option. They are a suitable choice for many investors seeking long-term growth.

- Target-Date Funds: These are the simplest option, automatically adjusting your asset allocation (the mix of stocks and bonds) as you approach your target retirement date. They are an excellent choice for hands-off investors who prefer a set-it-and-forget-it approach.

For most people, especially those just starting out, target-date funds or low-cost index funds offer a low-maintenance, diversified approach to investing, allowing them to participate in market growth without the stress of managing individual stocks or actively timing the market.

5. Conquer Your Inner Procrastinator: Action Trumps Perfection

A common obstacle to financial success is procrastination. People often delay taking action because they’re afraid of making mistakes, feel overwhelmed by the complexity of personal finance, or believe they need to have everything perfectly figured out before they start. Sethi emphasizes that imperfect action is better than perfect inaction. Starting small, even with modest contributions to savings or investments, is crucial for building momentum, establishing good financial habits, and overcoming the inertia of inaction.

6. Credit Cards: Use Them Wisely, Don’t Let Them Use You

Sethi doesn’t demonize credit cards; instead, he advocates for their strategic use. He recommends using credit cards for convenience, building credit history, and earning rewards, but always paying off the balance in full each month to avoid accumulating interest charges, which can quickly erode your wealth. He also encourages negotiating lower interest rates and annual fees with credit card companies to maximize their benefits and minimize their costs.

7. Negotiation: Unlock Your Earning Potential

Negotiating your salary is a crucial skill that can significantly impact your lifetime earnings. Sethi provides practical strategies for negotiating effectively, including researching industry benchmarks, highlighting your accomplishments, quantifying your contributions, and confidently presenting your value to your employer. He emphasizes that negotiation is a conversation, not a confrontation, and encourages individuals to approach it with confidence and preparation.

Conclusion: Take Control of Your Financial Destiny

“I Will Teach You To Be Rich” provides a practical, actionable roadmap to achieving financial freedom. By defining your rich life, automating your finances, focusing on big wins, conquering procrastination, using credit cards wisely, and mastering the art of negotiation, you can build a solid foundation for long-term financial success. Stop letting money control you; take control of your money and unlock the freedom to live the rich life you truly desire. This book, and the principles outlined here, offer a powerful starting point for anyone ready to embark on their journey to financial well-being and achieve their financial dreams.

Read more about Finance Here