The Psychology of Money by Morgan Housel offers a compelling look into how our thoughts and feelings about money can shape our financial outcomes. This book summary explores the key concepts and actionable insights from Housel’s work, providing a deeper understanding of the emotional and psychological aspects of wealth.

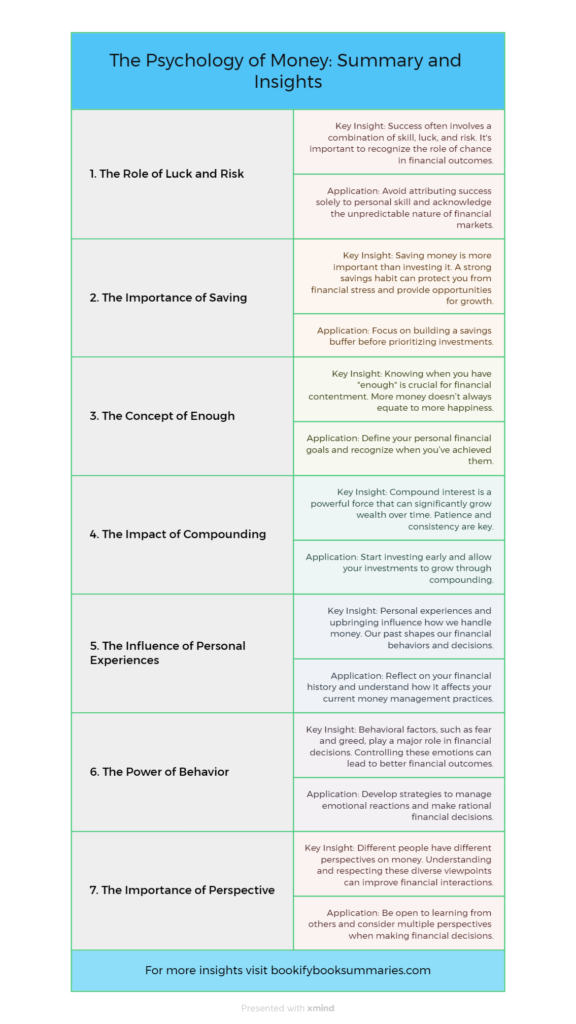

Personal Experiences Shape Financial Behaviors

Making money is always about behavior and handling rather than intelligence.

Ronald Read worked in a car shop and later as a sweeper, but he died with $8 million in his bank account. On the other side, Richard Fuscone, a Harvard graduate from an affluent family, lost everything during the 2008 financial crisis. Read was a patient investor; Richard was a hungry millionaire.

Finance is not a hard science like physics or chemistry since bodies do not think, however people do, making finance a soft science in which financial decisions vary based on what individuals belief and experience. If you began investing during the 2008 financial crisis and lost money, you may never return to the stock market. Following WWII, the US economy grew rapidly, while Japan and Germany’s economies virtually collapsed. Consider the experience of people in Japan, Germany, and the United States. Financial decisions are primarily influenced by what people are thinking at the time and the storylines that are playing in their thoughts, as well as their surroundings.

The Role of Luck and Risk

Take the example of lower-income persons in the United States. They spend an average of $412 on lottery tickets per year, but do not have $400 in their account for emergencies. Why didn’t they store money for an emergency? The answer is simple: because they are poor, they believe that only the lottery can help them improve their situation rather than saving money. Most of the time, financial outcomes don’t depend on mathematical calculations, but on luck or risk, as people make decisions based on their thoughts.

Bill Gates struck lucky early in his life. He attended a school with a computer lab. At the time, the likelihood of having a computer in the lab was one in a million. He became familiar with computers early in his childhood, which sparked his interest in computers at a time when many others were only fantasizing about computers in school.

To be a good investor, you need to do two things:

1) Set a long time horizon for your investment.

2) Be prepared to endure losses in some parts of your portfolio.

Let’s start with the time horizon. Warren Buffet began investing at the age of 11, and by 30, he had amassed $1 million; by 53, his fortune had grown to $58 million. If we apply the same growth rate and assume he began at the age of 30, he would have only made $20 million by the age of 53. Compounding, the eighth wonder of the world, works only if you stay invested for a long period without disrupting your portfolio.

What about about losses ?

You must have heard of mutual funds. A mutual fund invests money in a basket of companies, and after a set length of time, certain stocks do well and certain stocks do not, but the essential thing is that the fund should perform well overall.

Similarly, if you invest in a large number of equities, you should expect to lose money in at least some of them.

Let us take Disney as an example. Most of Disney’s animated films did not fare well at first and were not profitable, but one of its shows, Snow White, became an instant smash, and Disney became a popular cartoon firm, earning millions of dollars in income.

In the realm of finance, you only need one successful investment to cover all of your losses and generate enough profit to meet your objectives.

What is True Wealth?

Most of us consider what individuals flaunt as money, although this is far from the case. If someone buys a 1 crore Ferrari, the only thing you can say about his wealth is that it is 1 crore less.

Real wealth is your assets, properties, stocks, and savings, which you cannot just show off to others. It allows you to live life on your own terms. In the previous 50 years, the middle class has advanced significantly, while working hours have climbed. If you need appreciation, don’t show off, keep humble, and help others.

How and Why Should You Save Money?

Everyone saves money, whether through SIP or FD, but saving without a goal is worthless. Every savings goal should have a target; saving should also account for future uncertainties.

History teaches us that a black swan occurrence occurs once in a century, eroding employment, wealth, or the economy; therefore, you should be prepared for such disasters and have enough savings to get you through.

How can you determine the cost of uncertainty?

Consider that your source of income has suddenly disappeared, and you must survive for the next three months. What expenses do you need to pay, and what is your medical emergency? It might be EMI, health expenditures, and so on; the amount you need for all of these is your uncertainty cost. If you did not save for these events, you will have to withdraw your money and lose out on compounding.

The Role of Simplicity in Financial Success

1) Avoid financial bubbles and get rich quick schemes.

2) It is not good to invest by simply mimicking others. If things don’t go as planned, you’ll be wondering what went wrong. Whether you’re looking for the long or short term, you must have your own investment strategy. Without understanding the whole picture of the person you’re following, it’s better to stick to your own plan. This gives you complete control over your assets and allows you to make informed decisions that align with your financial goals.

11 Practical advice from The Psychology of Money :

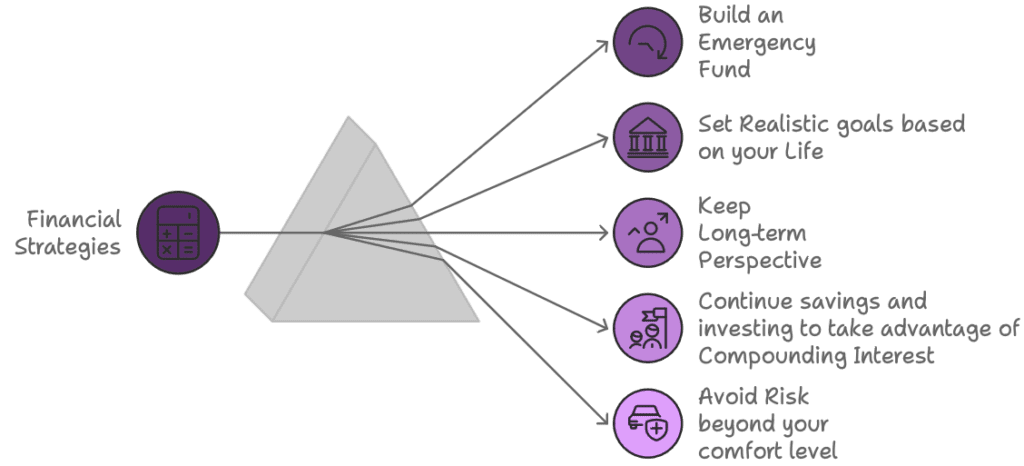

To build a strong financial foundation and ensure long-term stability, follow these key principles:

- Start Early: Begin saving and investing as early as possible to harness the power of compounding interest, which helps your money grow exponentially over time.

- Prioritize Saving: Focus on saving a substantial portion of your income rather than chasing high investment returns. Consistent saving habits are more important than striking it rich with risky investments.

- Think Long-Term: Make financial decisions with a long-term perspective. Avoid knee-jerk reactions to short-term market fluctuations, which can derail your investment strategy.

- Control Lifestyle Inflation: Resist the urge to increase your spending as your income rises. Maintain a modest lifestyle to ensure you have more funds to save and invest.

- Build an Emergency Fund: Set aside three to six months’ worth of expenses in an emergency fund to cover unexpected costs without derailing your financial plans.

- Stick to What You Know: Choose investments and strategies that you are familiar with and understand well. This reduces the risk of making costly mistakes with unfamiliar investments.

- Be Open to Learning: Stay receptive to new financial knowledge and advice. Be willing to adapt your financial strategies as needed to improve your financial health.

- Set Realistic Goals: Base your financial goals on historical data and realistic expectations. Prepare for a range of possible outcomes and avoid being overly optimistic.

- Focus on Long-Term Investments: Emphasize long-term investments to take full advantage of market growth and compounding returns over time.

- Manage Risk According to Your Comfort: Assess your investments against your risk tolerance and financial goals to manage risk effectively.

- Keep It Simple: Opt for straightforward financial strategies that are easy to understand and manage, which helps you stay on track and avoid unnecessary complications.

For more Finance knowledge click Here